does new mexico tax pensions and social security

March 24 2022 Posted by los angeles longshoreman jobs led strip lights with solar panel. The New Mexico Legislature on Thursday passed a bill eliminating taxes on Social Security benefits for individuals with less than 100000 in annual income or couples with less than 150000 in.

New Mexico Retirement Tax Friendliness Smartasset

New Mexico tax rates range from 17 to 59.

. Same goes for Social Security benefits. New Mexicos State Supplement to SSI. Then when they retire they are taxed again on the benefits they receive.

If HB 49 gets passed then it would extend to all retirees with social security income. Average pension value 2018. The bill includes a cap for exemption eligibility of 100000 for single filers and 150000 for married couples filing jointly.

So only 13 states remain. However many lower-income seniors can qualify for a deduction that reduces this overall tax burden. For more than half a century after Social Security was enacted in 1935 Social Security benefits were not taxed in New Mexico.

No New Hampshire tax on them. For more than half a century after Social Security was enacted in 1935 Social Security benefits were not taxed in New Mexico. New Mexicos tax on Social Security benefits is a double tax on individuals.

Up to 50 of your Social Security benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly. The changed COLA is expected to vary between 05 and 3 each year and average out to 164 annually compared to the current. Currently New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income.

Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt. Yes Up to 8000 exclusion. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each.

The following states tax Social Security benefits using basically the same method as the federal government. Removes the 90 percent salary cap on pensionable compensation. Today New Mexico is one of only 13 states that tax Social Security benefits.

For 2022 theres a. Social Security Benefits. The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year.

If you dont live in. Tax info505-827-0700 or taxnewmexicogov. Most of the people paying this tax in New Mexico are middle and lower income.

Low-income taxpayers may also qualify for a property tax rebate even if they rent their primary residence. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. 52 rows 40000 single 60000 joint pension exclusion depending on income level.

A ninth state New Hampshire only taxes capital gains and dividend income. As noted taxable Social Security benefits in New Mexico for tax year 2017 were about 19 billion. When New Mexicans are working the state taxes the money that is taken out of their paychecks for Social Security.

The income cut-off is 75000 for married individuals filing separate returns and 150000 for heads of household surviving spouses and married individuals filing joint returns. In 1990 the New Mexico Legislature passed a long and complex bill. Its important to note that New Mexico does tax retirement income including Social Security.

The tax costs the average New Mexico senior nearly 700 a year. Effective for 2022 tax year New Mexico will exempt Social Security retirement income from taxation for individual retirees who make less than 100000 annually. New Mexico is one of only 12 states that tax Social Security income and it is a form of double taxation since New Mexicans pay income taxes on the money they put into.

In New Mexico low income retirees are not taxed on their social security income. Does new mexico tax social security. Assuming an average tax.

Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming dont tax income at all. Heres a breakdown of the feds rules per AARP. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500 or less for singles to deduct up to 8000 in income that can be applied to benefits.

Up to 20000 exclusion for pension annuity or Def. And five states Alabama Illinois Hawaii Mississippi and Pennsylvania exclude pension income from state taxes. New Mexico and Utah place a duty on Social Security based on what the federal government taxes.

IRS for tax year 2017 and using a guesstimate of the average New Mexico tax rate faced by New Mexico recipients of taxable Social Security benefits.

6 Pros And Cons Of Retiring In New Mexico 2020 Aging Greatly

New Mexico Passes Legislation Including Social Security Tax Cuts Child Tax Credit And Tax Rebates Up To 500 Gobankingrates

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

Where S My Refund New Mexico H R Block

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

New Mexico Retirement Tax Friendliness Smartasset

Guide To New Mexico Disability Benefits

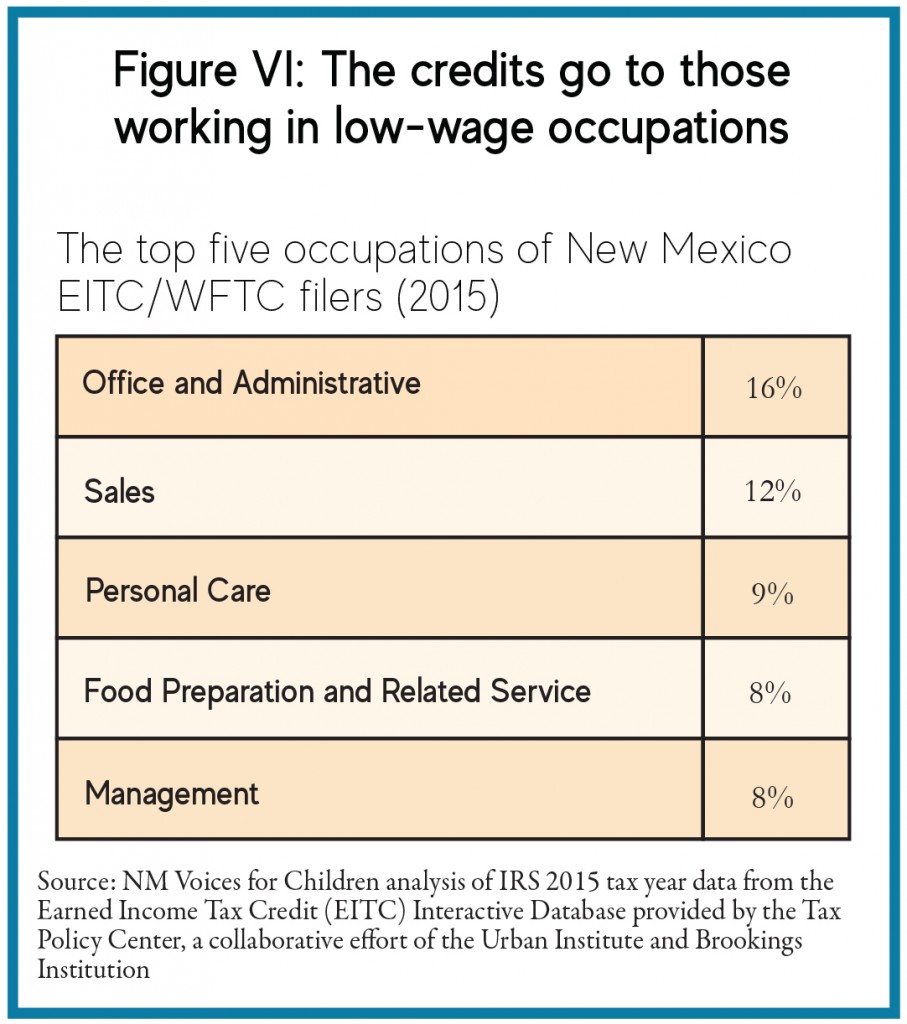

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

Social Security Income Tax Exemption Taxation And Revenue New Mexico

New Mexico May Limit Or Scrap Tax On Social Security Income New Mexico News Us News

Retirement Security Think New Mexico

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

Retirement Security Think New Mexico

Retirement Security Think New Mexico

Retirement Security Think New Mexico

Retirement Security Think New Mexico

The Best States For An Early Retirement Early Retirement Life Insurance Facts Life Insurance For Seniors